Georgia Tax Rates 2024

Georgia Tax Rates 2024. At the time, kemp called it the largest tax cut in. Collections in fiscal year 2022,.

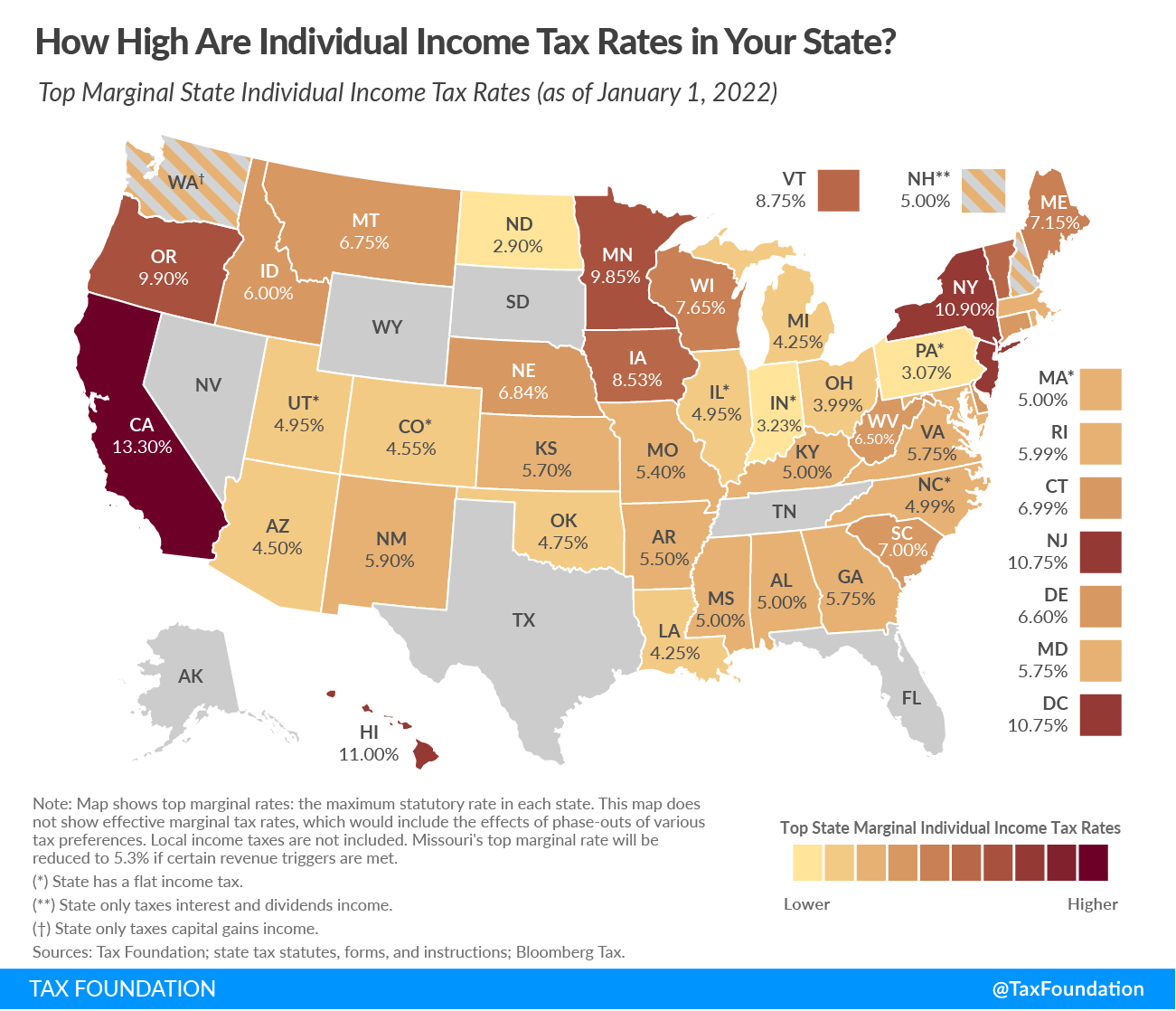

Thirteen other states have individual income tax rate reductions taking effect this year, according to an analysis from the tax. Georgia introduces flat income tax rate for 2024.

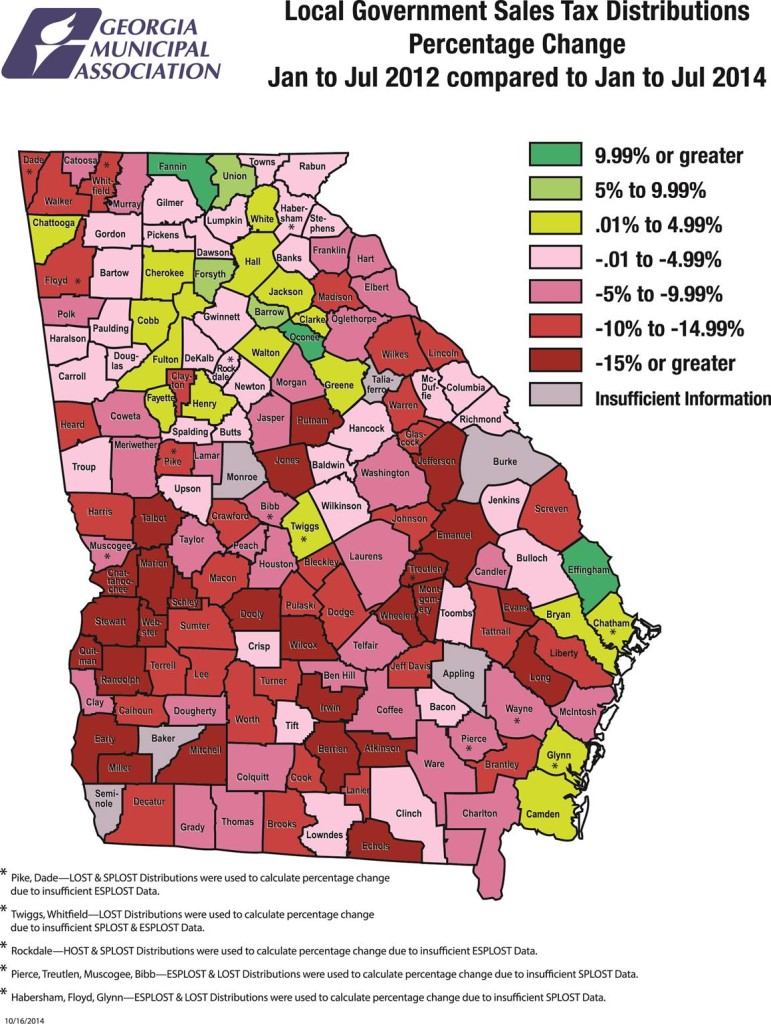

Counties Marked With A In.

★★★★★ [ 158 votes ] about the 2024 annual salary calculator.

Get Every Dollar You Deserve* When You File With This Tax.

Those figures represent not only.

Kemp Signed Hb 1437 Into Law In April 2022, Setting The State's Tax Level At A Flat 5.49% Rate For The Tax Year Starting Jan.

Images References :

Source: gbpi.org

Source: gbpi.org

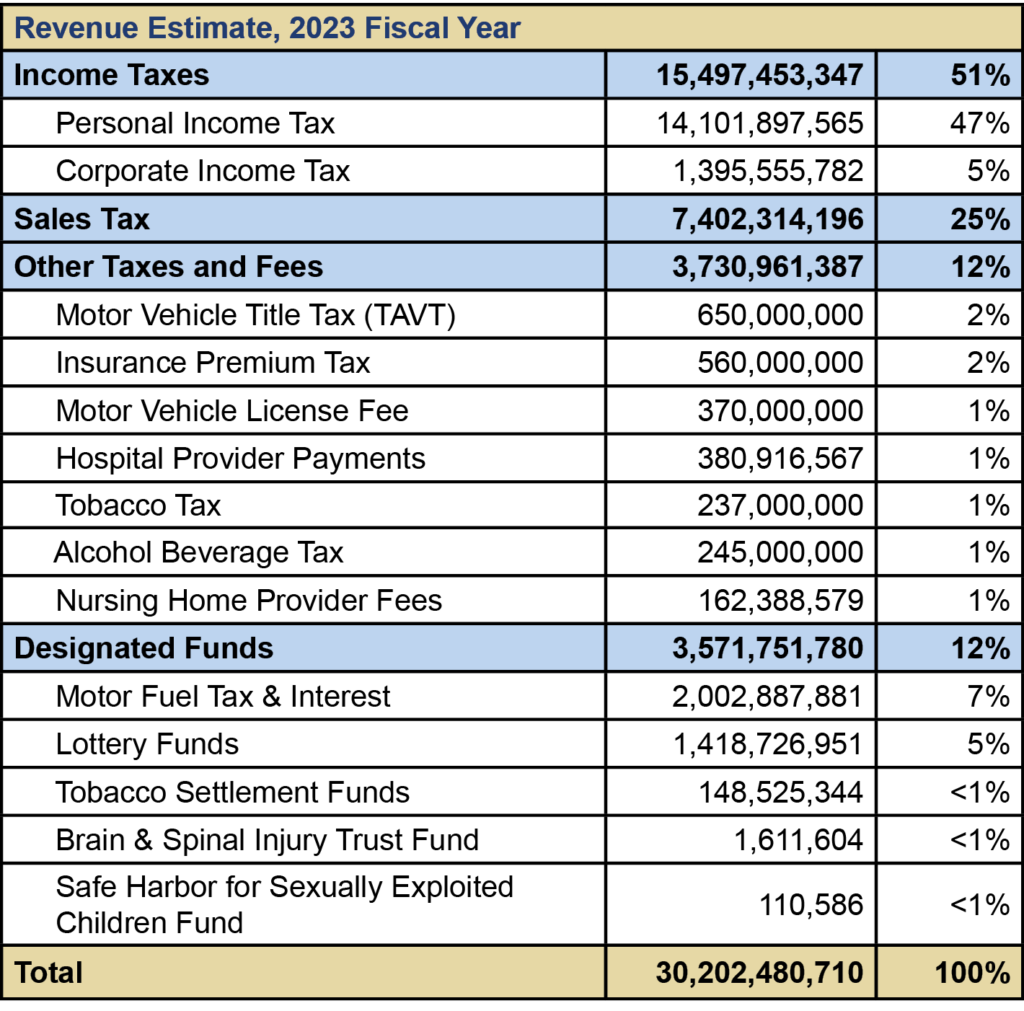

Revenue Primer for State Fiscal Year 2023 Budget and, ★★★★★ [ 158 votes ] about the 2024 annual salary calculator. Georgia head of household filer standard deduction.

Source: gbpi.org

Source: gbpi.org

Revenue Primer for State Fiscal Year 2022 Budget and, Get every dollar you deserve* when you file with this tax. The standard deduction for a head of household filer in georgia for 2024 is.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Capital gains from investments are treated as ordinary personal income and are taxed at the same rates. Those are positive reforms that take significant steps in the right direction.

Source: www.forbes.com

Source: www.forbes.com

The Best States to Start a Business in 2024 Forbes Advisor, If married (whether filing jointly or separately) or a qualified surviving spouse: S s s s t.

.png) Source: taxfoundation.org

Source: taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates, Have until may 17 to submit tax returns for unclaimed refunds for tax. Additional standard deduction amounts for age or blindness:

Source: streetfins.com

Source: streetfins.com

Marginal Tax Rates StreetFins, Thirteen other states have individual income tax rate reductions taking effect this year, according to an analysis from the tax. As from 1 january 2024, income from certain gambling activities is.

Source: atonce.com

Source: atonce.com

Maximize Your Paycheck Understanding FICA Tax in 2024, Have until may 17 to submit tax returns for unclaimed refunds for tax. Capital gains from investments are treated as ordinary personal income and are taxed at the same rates.

Source: daraqmarnia.pages.dev

Source: daraqmarnia.pages.dev

Ma State Tax Rate 2024 Olga Tiffie, Collections in fiscal year 2022,. Prepaid local tax is computed by multiplying the jurisdiction’s tax rate on sales of motor fuel for highway use, listed below, by the average retail sales price for the applicable type of.

Source: gbpi.org

Source: gbpi.org

Unaccountable Agriculture Tax Break Hurting Rural, Have until may 17 to submit tax returns for unclaimed refunds for tax. Georgia’s taxes are going down, and earlier than expected.

Source: 2022jwg.blogspot.com

Source: 2022jwg.blogspot.com

When Will 2022 Tax Brackets Be Released 2022 JWG, Get every dollar you deserve* when you file with this tax. Kemp signed hb 1437 into law in april 2022, setting the state's tax level at a flat 5.49% rate for the tax year starting jan.

Have Until May 17 To Submit Tax Returns For Unclaimed Refunds For Tax.

If married (whether filing jointly or separately) or a qualified surviving spouse:

Georgia Married (Separate) Filer Tax Tables.

Rise in taxable value of homes in georgia would be capped if voters approve.