Eitc 2024

Eitc 2024. Learn how to claim the earned income tax credit (eitc) when you file your taxes. And, honestly, it can be a saving grace.

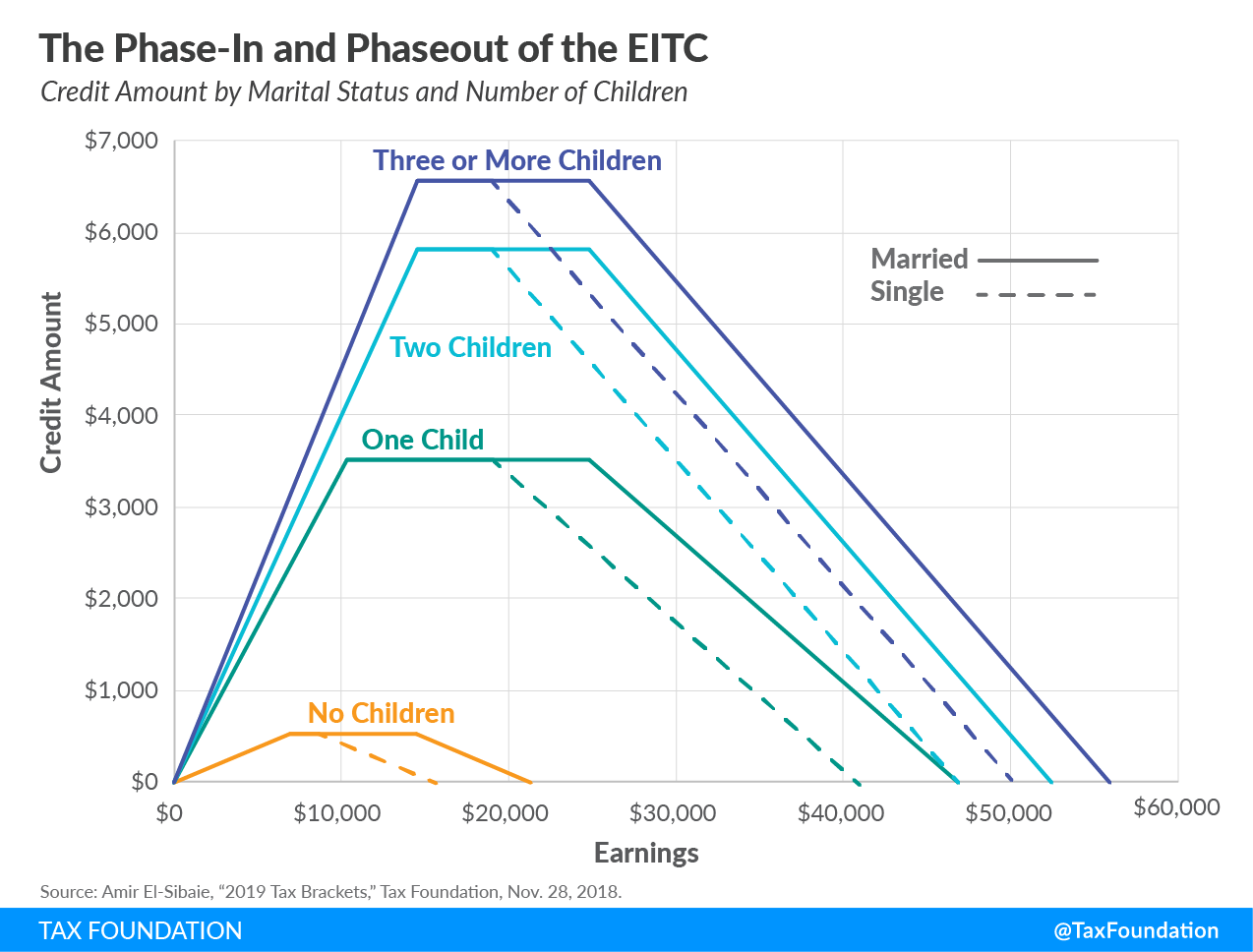

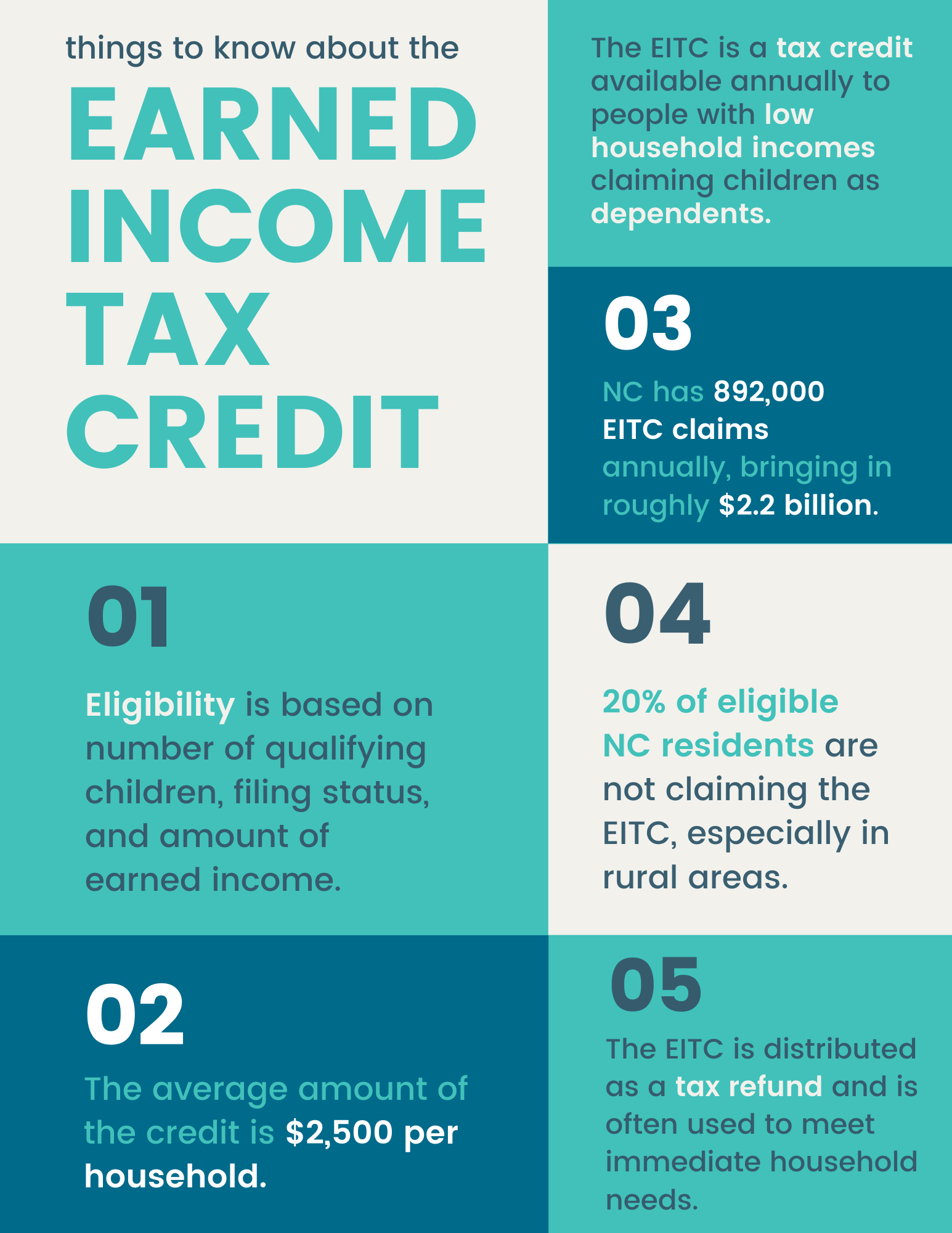

The tax credit for 2024 tax returns can range from $600 to $7,430 based on the number of children,. $7430 eitc refund eligibility 2024.

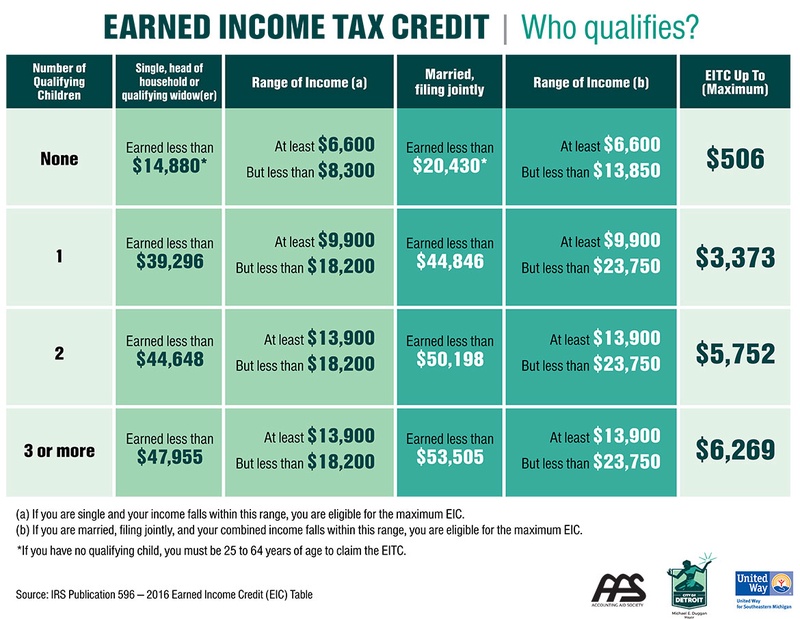

To Claim The Earned Income Tax Credit (Eitc), You Must Have What Qualifies As.

$7430 eitc refund eligibility 2024.

Everything You Need To Know About The Earned Income Tax Credit (Eitc) In 2024.

One in five low to moderate earners eligible to receive a check from the u.s.

Eitc Refund Amount In 2024.

Images References :

Source: www.youtube.com

Source: www.youtube.com

EITC TAX CREDIT 2022 EARNED TAX CREDIT CALCULATOR 2022 YouTube, Use eitc tables to find the maximum credit amounts you can claim for the credit. Learn how to claim the earned income tax credit (eitc) when you file your taxes.

Source: www.hawaiiworkerscenter.org

Source: www.hawaiiworkerscenter.org

Earned Tax Credit (EITC) Hawai'i Workers Center, Greetings eitc, over the past several months the fix transactive resources wg has met regularly to provide input to the developing cts specification. Everton in the community has been shortlisted for two awards at the prestigious football.

Source: www.brookings.edu

Source: www.brookings.edu

The American Families Plan Too many tax credits for children? Brookings, Even though it takes a little extra work. Eitc refund amount in 2024.

Source: brittniwtoni.pages.dev

Source: brittniwtoni.pages.dev

Eitc 2024 Release Date Donna Gayleen, One in five low to moderate earners eligible to receive a check from the u.s. Eitc refund amount in 2024.

Source: v-s.mobi

Source: v-s.mobi

Download IRS TAX REFUND 2023 IRS REFUND CALENDAR 2023 ? EITC, CTC, The tax year 2024 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from. Greetings eitc, over the past several months the fix transactive resources wg has met regularly to provide input to the developing cts specification.

Source: techplanet.today

Source: techplanet.today

The Ultimate Guide to Help You Calculate the Earned Credit EIC, Individuals who live in maine and massachusetts have until april 17, 2024, to file their 2023 form 1040. California employers association on thursday, march 21, 2024.

Source: upstatetaxp.com

Source: upstatetaxp.com

Treasury Audit Highlights the Need for Clearer Eligibility Guidelines, On july 10, 2023, california adopted senate bill (sb) 131 to update requirements for. Even though it takes a little extra work.

Source: www.taxoutreach.org

Source: www.taxoutreach.org

Six Ways to Promote the EITC for Awareness Day Get It Back, Help us reach the workers who qualify. For tax returns filed in 2024, the tax credit.

Source: www.cpapracticeadvisor.com

Source: www.cpapracticeadvisor.com

Here Are the 2024 Amounts for Three Family Tax Credits CPA Practice, Claiming the credit can reduce the tax you owe and may. To claim the earned income tax credit.

Source: jordaninstituteforfamilies.org

Source: jordaninstituteforfamilies.org

Increasing Family Wealth through EITC The Jordan Institute for Families, Eitc tax refunds in 2024. For tax returns filed in 2024, the tax credit.

The Earned Income Tax Credit (Eitc) Is A Valuable Refundable Tax Credit That Can Significantly Reduce Your Tax Liability Or Increase Your Refund If You Qualify.

The tax credit for 2024 tax returns can range from $600 to $7,430 based on the number of children,.

$7430 Eitc Refund Eligibility 2024.

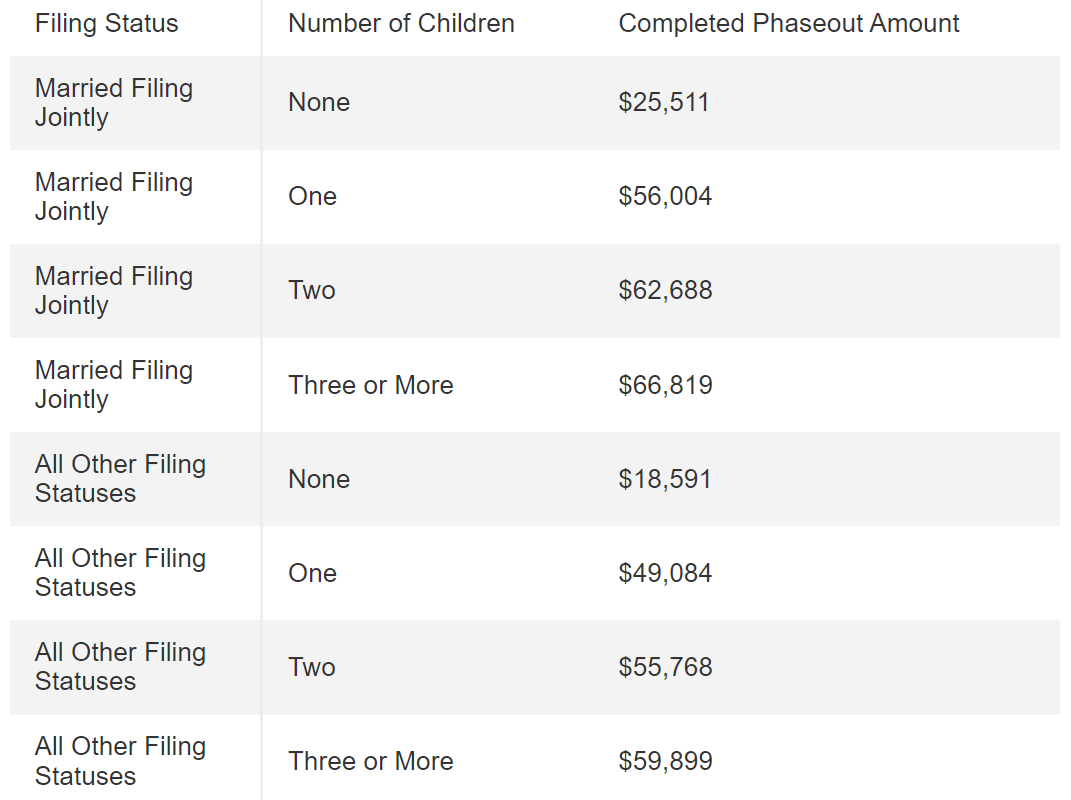

To qualify for the eitc in 2024, taxpayers must meet income requirements based on their filing status and the number of qualifying.